Uncovering Secrets: Hookup Detectives

Explore the world of modern relationships and dating with insights from our hookup detectives.

Cashout Conundrums: Decoding Withdrawal Methods and Fees

Unlock the secrets of withdrawal methods and fees! Discover the best cashout strategies and save money today in our latest blog post!

Understanding Withdrawal Options: Which Method is Right for You?

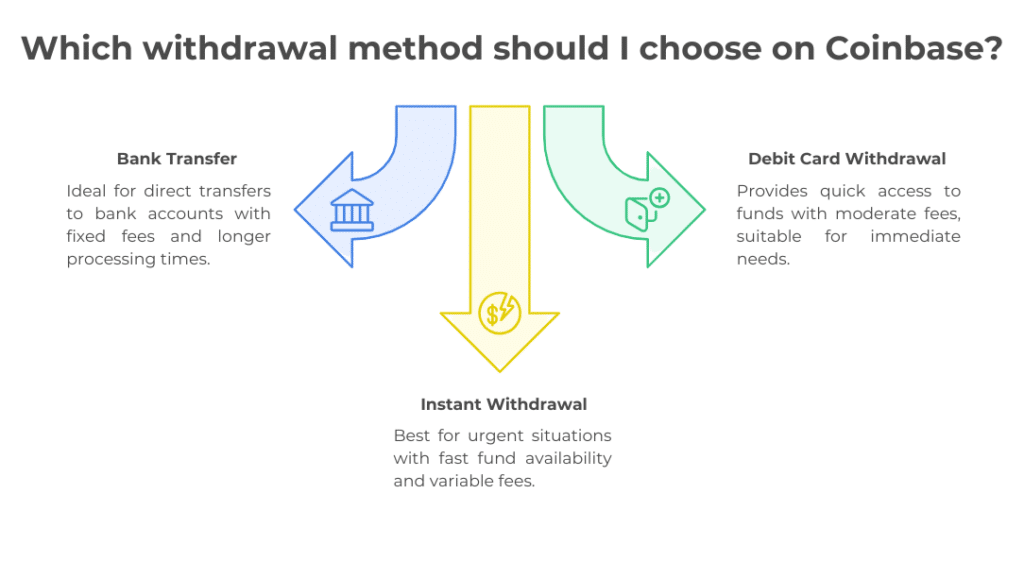

When it comes to managing your finances, understanding withdrawal options is crucial. Whether you're dealing with retirement accounts, investment platforms, or online casinos, each method has its own set of rules and implications. Some common methods include bank transfers, checks, and e-wallets. Each option varies in terms of speed, convenience, and fees, making it essential to evaluate which method is right for you based on your financial needs.

Before making a decision, consider the following factors:

- Withdrawal Speed: How quickly do you need the funds?

- Fees: Are there any transaction fees associated with the withdrawal method?

- Accessibility: Is the withdrawal method easy for you to use?

To get the best deals on your next gaming experience, make sure to take advantage of the duel promo code that offers exclusive discounts and bonuses.

Hidden Fees Unveiled: What to Look for When Cashing Out

When it comes to cashing out your hard-earned money, being aware of hidden fees can save you from unpleasant surprises. These fees can vary significantly depending on the platform or service you’re using. Common hidden fees include transaction fees, withdrawal fees, and conversion fees. Always read the fine print before making a decision, as many companies provide detailed information about their fee structure in their terms and conditions. You can often find these fees categorized as:

- Transaction fees

- Withdrawal fees

- Currency conversion fees

Understanding where these fees arise is crucial. For instance, a popular cash-out method may not impose fees for certain accounts but could charge for others based on account status or transaction size. Additionally, always look for service reviews or guides to get insights into other users’ experiences, as they often reveal unexpected costs associated with cashing out. Protect yourself by creating a checklist of potential fees to look out for:

- Check for any flat fees per transaction

- Investigate percentage-based fees based on your withdrawal amount

- Assess if there are any inactivity fees or additional charges for expedited transactions

How Long Does It Take to Withdraw Your Earnings? Common Timelines Explained

When it comes to understanding how long it takes to withdraw your earnings, several factors can influence the timeline, including the payment method you choose and the policies of the platform you’re using. For instance, e-wallets like PayPal and Skrill typically offer the fastest withdrawals, often processing your request within 1 to 2 business days. In contrast, bank transfers and checks may take significantly longer, sometimes extending the wait time to 5 to 10 business days. Additionally, some platforms may require a processing period before allowing withdrawals, which can further delay access to your funds.

To provide a clearer picture, here's a quick overview of common withdrawal methods and their typical timelines:

1. E-wallets: 1 to 2 business days

2. Credit/Debit Cards: 3 to 5 business days

3. Bank Transfers: 5 to 10 business days

4. Checks: Up to 14 business days

If you’re looking to receive your earnings quickly, it’s crucial to select the withdrawal option that aligns with your needs and to review any specific terms of service related to withdrawals on your chosen platform.